Explore the Admin Panel

Overview

Welcome to the Admin Panel, you central hub for fighting fraud. This is where you’ll get most things done in SEON: you’ll review transactions and customers here, access insightful statistics, and fine-tune settings by creating and customizing rules to be applied when analyzing user actions to filter out fraudsters. It’s time to get familiar with all the magic that happens on the Admin Panel.

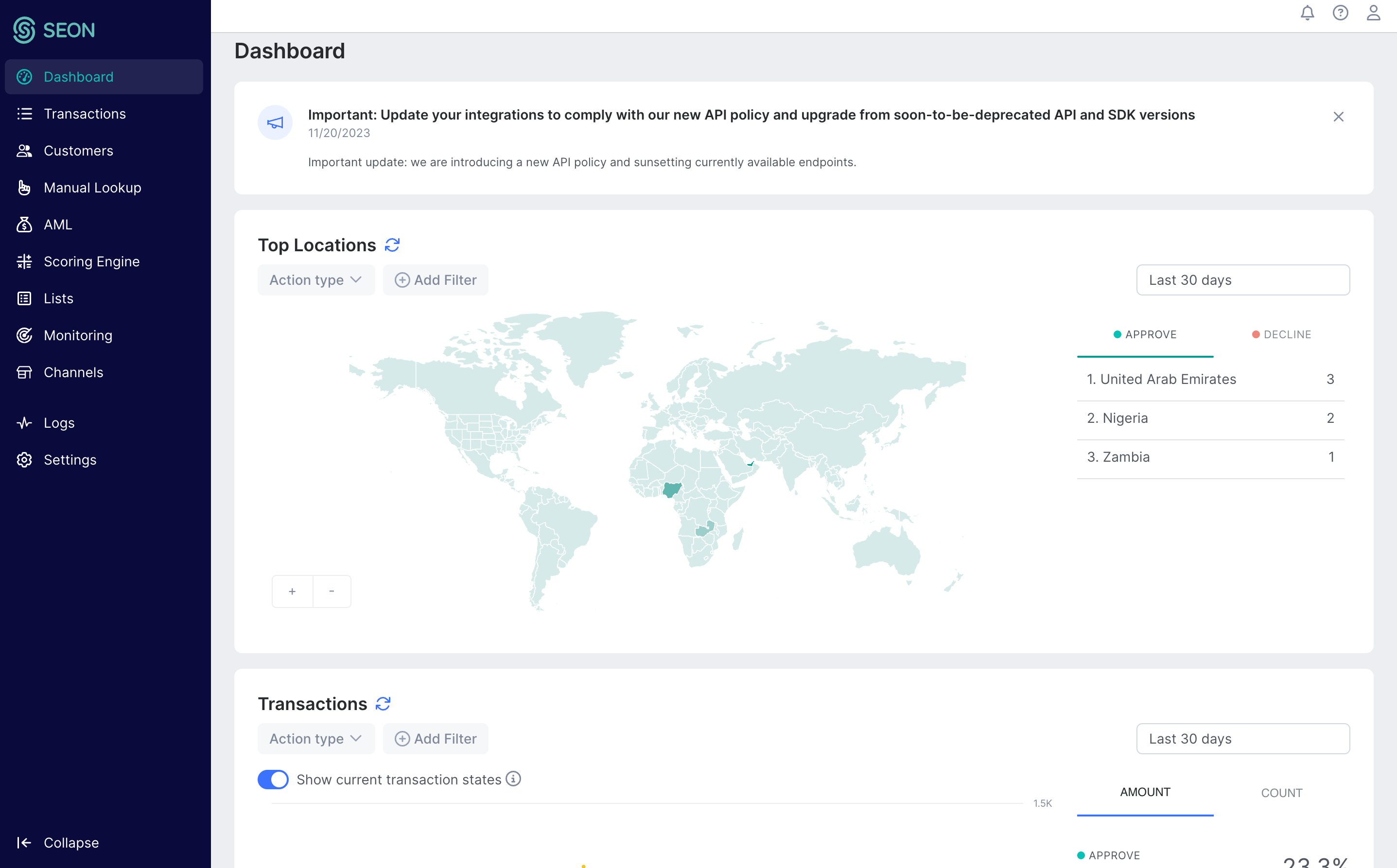

The Dashboard

Right after logging into seon.io, you’ll find yourself on the Dashboard. We share product updates right at the top to keep you in the loop. At SEON, we're always rolling out updates based on feedback from our customers, so keep an eye on the Admin Panel for the latest updates that make your job easier.

Below, you’ll find widgets where you can keep an eye on overall statistics, such as Total Transactions, Total Amount and Total Saved Amount. You’ll also find a map-based overview of your transactions and can find a summary of the most commonly applied rules to keep you on track with risk trends or behaviors specific to your business.

The sidebar

You can access all of SEON's powerful features from the sidebar on the left side of the window.

The Transactions page lists every user action SEON analyzed. You can find key details here and dive a level deeper into certain transactions to review suspicious activities.

The AML page is the heart of your anti-money laundering efforts, head here to review AML checks and enable automatic AML monitoring.

The brain of SEON, the Scoring Engine hosts the rules that are used to decide whether a transaction is suspicious or not. You can enable, disable, create, and edit rules here to customize SEON to your own business needs.

The Lists page is where you can review what data has been added to a white or blacklist. Basically, data on the whitelist will always be approved, while anything on the blacklist gets declined.

Doing a Manual Lookup

Let’s kick things off by taking a longer look at the Manual Lookup page. You’ll be able to investigate individual cases here and make informed decisions simply by providing a single data point from day one, even before completing your API integration.

- On the Add New tab of the Manual Lookup page, select the type of data point you have at hand to run a manual lookup with.

- Let’s say you have an email address you’d like to check on. Type in the email and click Run email lookup, then let SEON do its magic.

- Utilizing the power of data enrichment, SEON will provide you with a lot of publicly available additional information, only based on the single email address you entered.

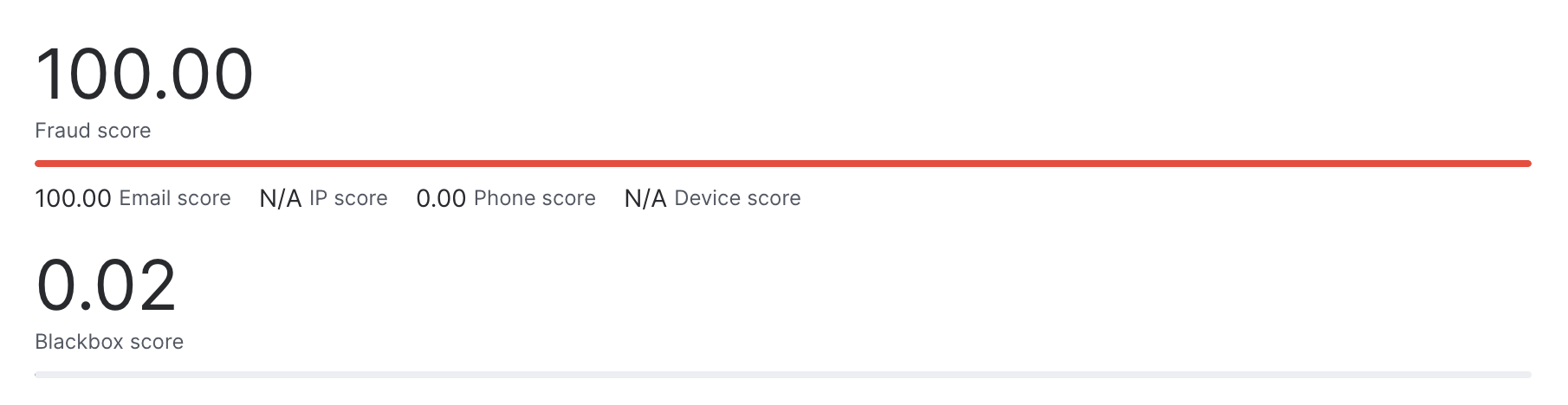

- Based on the data gathered and a set of default rules in SEON’s brain, the Scoring Engine, that were designed to filter out typical fraudulent behavior, we assign a fraud score to the email address to better assess how risky the user behind it is.

Transactions, fraud scores, transaction states: The Basics

To better understand how SEON actually works, let’s have a look at the most basic concepts behind this fraud prevention machine.

Transaction

A key element in this well-oiled machine, the smallest unit of information we process, is the user action itself, which we collectively call transactions in SEON. This could be anything from a login to a payment attempt. A transaction is also created in our system when you run a manual checkup from the Transaction tab of the Manual Lookup Page.

Fraud score

As mentioned above, whenever you do a manual lookup or SEON automatically checks a user action, a so-called fraud score gets calculated. This score, on a scale of 0 to 100 is based on all the information SEON gathers through data enrichment, the default and custom rules applied when processing user actions, and the input of our machine learning tools. Let’s just say it’s not merely an empty allegation but rather a well-informed and reliable piece of information to base decisions on.

Transaction states

Based on the fraud score and the rules set up by default or finetuned by you, tailored to your preferences, all transactions are categorized into three different states, depending on how risky they appear to be.

- DECLINE: The transaction appeared to be risky and got a high enough risk score to be automatically declined.

- APPROVE: The transaction appeared to be genuine, and got the green light automatically.

- REVIEW: The transaction needs to be reviewed manually before being approved or declined, as based on the available information, SEON could not make an automated decision.