AI insights score and explanation

Updated on 21.01.26

5 minutes to read

Copy link

Overview

The AI insights score is a real-time, AI-generated fraud probability score. It detects complex fraud patterns and anomalies that rules might miss while continuously retraining to stay up to date.

What the AI insights score measures

The AI insights score calculates fraud probability on a scale from 0 to 100. A higher score indicates greater risk.

It is calculated from more than 900 first-party data points, including device fingerprints, behavioural patterns, velocity metrics, consortium signals and digital footprint characteristics.

Key capabilities include:

- Real-time AI scoring: Produces a risk score immediately when a transaction or user is evaluated.

- Pattern recognition: Uncovers intricate risky patterns and correlations too subtle for manual analysis.

- Use in decision logic: Can feed directly into rules, triggers or automated actions.

- Continuous retraining: Retrains daily to adapt to evolving fraud tactics.

- Explainability: Click Explain beneath the score or in the AI summary to see which signals drove the score higher or lower.

- Configurable: Administrators can enable or disable the AI insights score in the AI & Machine Learning settings within the SEON Admin panel.

Because the AI insights score is a probability score, SEON recommends using labels and feedback loops to refine the model over time. Read more about best practice for labels here.

What's behind the score

The model analyzes 900+ first-party fraud signals for each transaction. It looks at user behavior, device details, digital footprint signals and consistency across data points.

Some of the top features used in decisions include:

- Action type (e.g. login, purchase, registration)

- Email type (disposable or not)

- Number of linked social media accounts

- Proxy or VPN usage

- Screen resolution and browser settings

- Country and location mismatches

These features are weighted based on how much they influence fraud risk. The more influence a signal has, the more impact it has on the score. Each customer's fraud pattern is different, thus the AI insights score’s algorithm learns from all data signals and uses the relevant features in customer-specific models.

How to enable and interpret the AI insights score

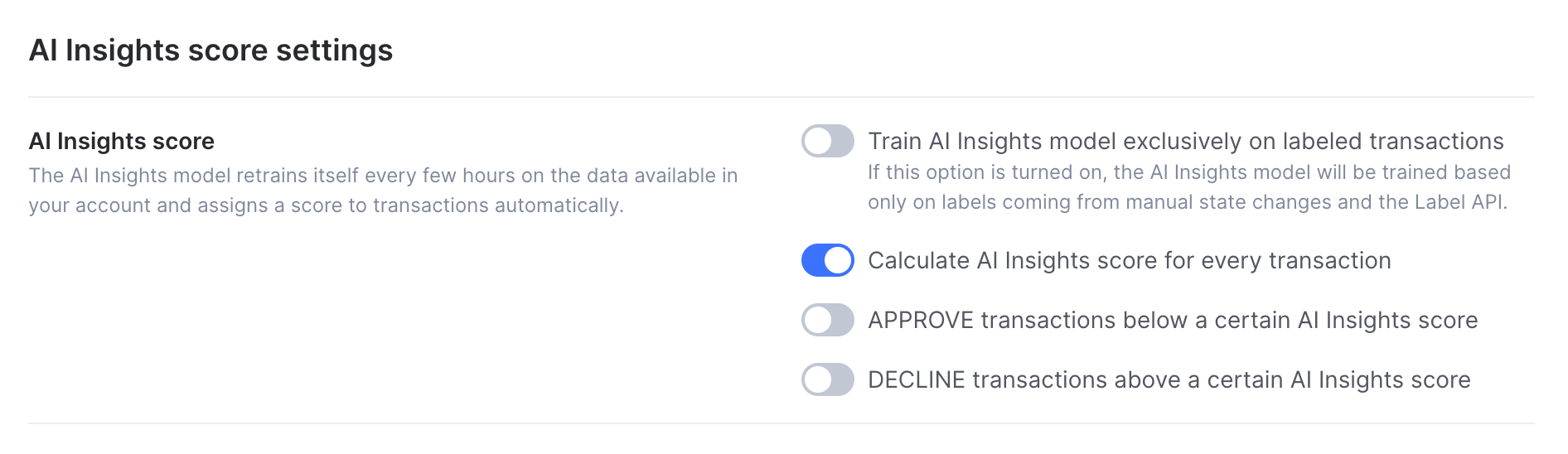

While the AI insights score is enabled by default for new customers, Administrators can enable or disable the AI insights score by navigating to Settings -> System -> AI & Machine Learning and navigating to the AI insights score settings. Once activated, the score appears for new transactions and alerts.

The AI insights score complements SEON’s rule-based fraud score. Rules remain transparent and under your control, while the AI insights score provides an additional layer of intelligence, reveals the rationale behind the score and catches patterns that static rules and human analysis might miss.

Model training process

When you first start using SEON, your account will likely not contain enough custom data for the AI Insights model to work efficiently. However, thanks to our base model, you can benefit from its speed and accuracy from day one.

The base model is an anonymized collection of transactions encountered by SEON that we use to train the AI insights model’s algorithm. The base model turns off when your account passes 1000 events, with at least 100 in the DECLINE state and 100 in the APPROVE state. Once you have passed this threshold, the AI insights model will train on your unique data.

How to provide training data to the custom AI insights model

- Submit data via the Fraud API and use rules to create approve and declines decisions (by rules and / or manually)

- Label transactions using the Label API for train the model based on real-world outcomes

How to configure model training

- Enable learning only from labeled transactions in the AI and machine learning settings will further fine-tune the AI insights Score based on the use case the labels.

- To automate fraud prevention using the AI insights model, enable the Approve transactions below a certain AI insights score and Decline transactions above a certain AI insights score toggles. A slider will appear for you to set the thresholds according to your risk appetite. Feel free to adjust these values at any time, based on your results with AI IInsights.

AI insights score explanation

Traditionally, AI and machine learning models are difficult to interpret for humans and are often unexplainable. SEON’s AI insights score explanation provides an additional layer of depth behind it to provide visibility into the key factors that influenced each score.

This tool gives users visibility into the factors behind the score, making the model more explainable and building trust in automated decisions.

How to access it

There are two ways to access the AI insights score explanation:

- From the AI summary: Click the AI insights explanation link within the Next Steps in the AI summary panel.

- From the score breakdown: Beneath the AI insights score in the transaction or alert view, click Explain.

Both options open a breakdown of which data signals had the biggest impact on the score, divided into positive and negative contributors.

What is shows

The explanation behind the AI insights score uses a visual graph to display the top signals driving the score. Each factor is shown with a bar indicating how much it pushed the score up or down. The most impactful signals are listed at the top.

Examples of signals:

- Positive impact: Signals of legitimate transactions that could push the score lower include region language match, Netflix or Tumblr account existence, IP type, billing match.

- Negative impact: Signals of a risky transactions that push the score higher include use of uncommon payment methods, disposable emails, absence of social media accounts.

Each feature is accompanied by a short explanation, so you understand what it means and why it mattered in this decision.

Benefits

The AI Insights score explanation bridges the gap between AI and machine learning and human understanding, bringing trust to AI-powered fraud detection.

- Transparency: You no longer have to guess why a score is high or low

- Confidence: Analysts can see the logic behind decisions

- Better decisions: Knowing what’s driving risk helps focus investigation time